Hope Brook Project (20% Interest)

- Project Overview

- Technical Reports

- Photo Gallery

Project Overview:

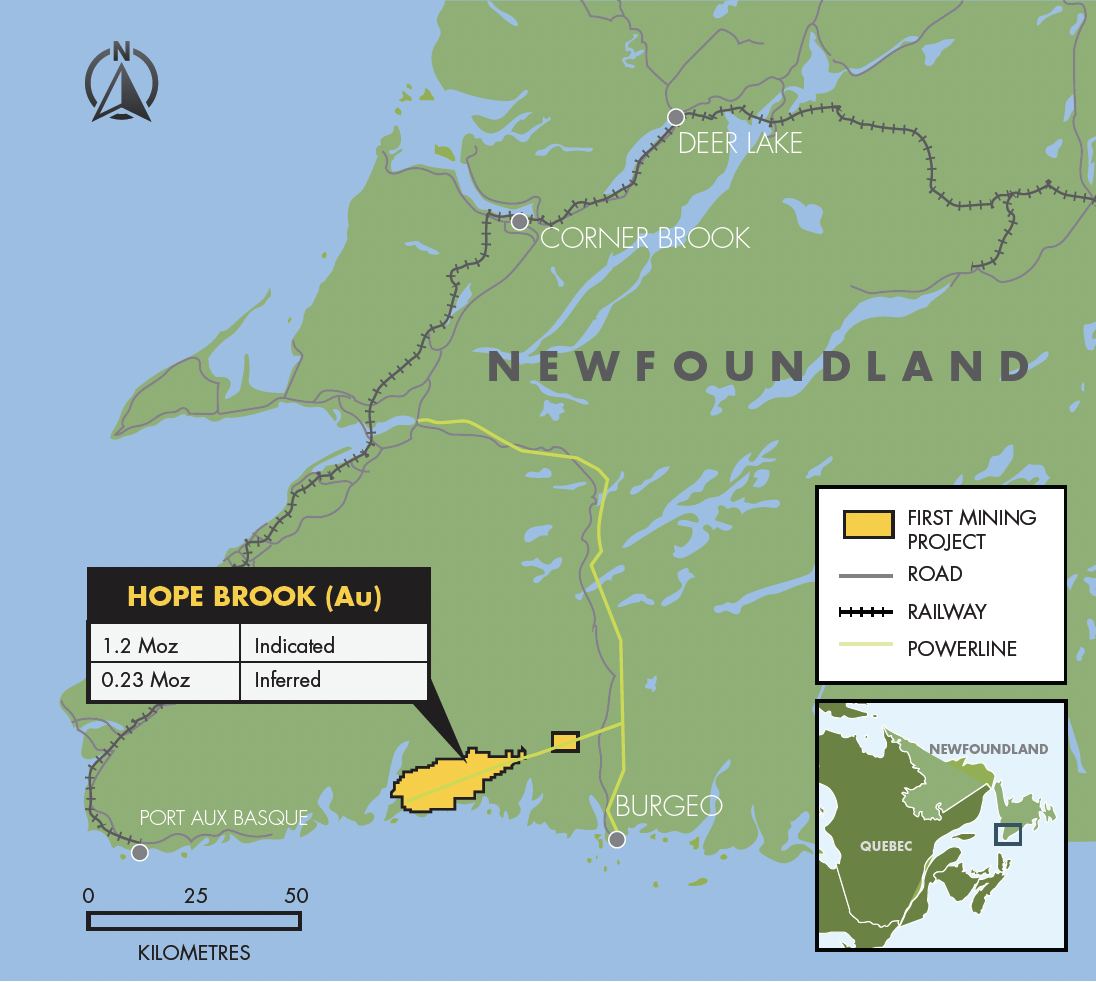

First Mining holds a 20% interest in the Hope Brook Gold Project in Newfoundland, Canada, which is being advanced in partnership with Big Ridge Gold Corp.

The Hope Brook Project is an advanced stage, high-grade gold project with a former operating gold mine that produced 752,163 ounces of gold from 1987 to 1997. It is located 85 km east of the community of Port aux Basques and covers an area of 24,475 hectares over ten mineral licenses. There is well maintained infrastructure on site, including an operational 28-person camp, an 1,100 m airstrip, ice-free docking facility and connection to the provincial electrical power grid via an on-site substation.

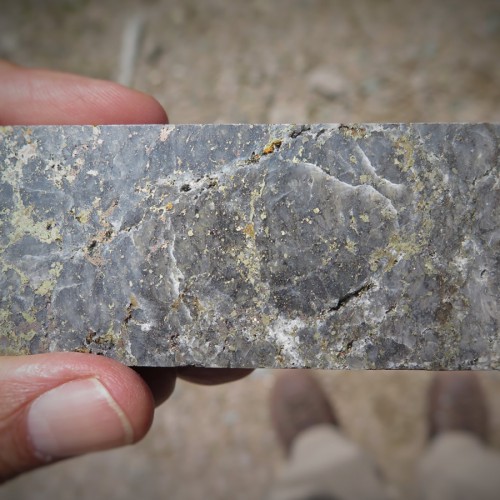

The deposit is a large, disseminated gold-chalcopyrite-pyrite deposit hosted by highly altered sedimentary and volcano-sedimentary rocks, intruded by a similarly altered, quartz-feldspar porphyry sill-dike complex of the Roti Intrusive Suite. Zones hosting gold mineralization of economic interest typically bear evidence of intense silicification and occur within a broad envelope of advanced argillic alteration (AAZ) characterized by the presence of silica, sericite, pyrophyillite, kaolinite, alunite, pyrite, chalcopyrite and gold. This structure is approximately 500 m wide and can be traced for up to 8 km southwest of the deposit.

The Project hosts an Indicated mineral resource of 16 Mt grading 2.32 g/t Au for 1.2 million ounces of gold, and an Inferred resource of 2.22 Mt grading 3.24 g/t Au for 231,000 ounces of gold.

History:

First Mining acquired Coastal Gold and the Hope Brook property in July 2015.

On April 6, 2021, First Mining entered into a definitive agreement with Big Ridge Gold Corp. (“Big Ridge”) (TSX-V:BRAU) whereby Big Ridge may earn up to an 80% interest in First Mining’s Hope Brook Gold Project.

On September 13, 2021, Big Ridge completed Stage 1 of the Earn-In, increasing its ownership interest in Hope Brook to 51%, and has until June 8, 2026 to acquire an additional 29% direct interest.

On March 28, 2024, Big Ridge completed Stage 2 of the Earn-In, increasing its ownership interest in Hope Brook to 80%

| Earn-In Details 1 |

|---|

| Upfront Consideration (Complete) |

| • $500,000 cash upon closing |

| • 11.5 million shares of Big Ridge upon closing |

| Stage 1 Earn-in (51% earn-in over 3-year period) (Complete) |

| • $10 million in qualifying expenditures |

| • 15 million shares of Big Ridge |

| • 1.5% NSR royalty (0.5% buyback for $2M) |

| Stage 2 Earn-in (+29% to 80%) - Amended on March 21, 2024 (Complete) |

| • 10 million shares of Big Ridge |

| Additional Terms |

| • JV to be created upon completion of Stage 1 |

| • First Mining free carried to a feasibility study |

| • $2M cash payment upon commercial production |

| 1 See First Mining News Release dated April 6, 2021 for further details |

Project Highlights:

- New Mineral Resource Estimate released in January 2023 which contemplates open-pit mineral extraction and identifies both in-pit resources and out-of-pit resources considered accessible by underground mining methods.

- 16.2 Mt grading 2.32 g/t Au for a total of 1.2 million ounces in the Indicated category and 231,000 ounces grading 3.24 g/t Au in the Inferred category

- Includes: Open Pit Mineral Resource Estimate of 1.0 million ounces grading 2.14 g/t Au in the Indicated category

- Significant infrastructure on site which includes an operational 28-person camp, a 1,100 m airstrip, ice-free docking facility, and connection to the provincial electrical power grid via an on-site substation.

- Strong support from community and government of Newfoundland

- Previous operator of the project produced 752,163 ounces of gold between 1987 and 1997.

Hope Brook Project Mineral Resources (effective January 17, 2023)

| IN PIT | |||||

| Hope Brook | Cut-off Grade (g/t Au) |

Tonnes | Grade (Au g/t) |

Contained Gold Ounces |

|

| INDICATED | |||||

| Main Zone | 0.4 | 14,584,000 | 2.14 | 1,002,000 | |

| UNDERGROUND | |||||

| Hope Brook | Cut-off Grade (g/t Au) |

Tonnes | Grade (Au g/t) |

Contained Gold Ounces |

|

| INDICATED | |||||

| 240 Zone | 2.0 | 544,000 | 4.31 | 75,000 | |

| Main Zone | 2.0 | 1,062,000 | 3.78 | 129,000 | |

| INFERRED | |||||

| 240 Zone | 2.0 | 1,994,000 | 3.28 | 210,000 | |

| Main Zone | 2.0 | 221,000 | 2.96 | 21,000 | |

| IN PIT AND UNDERGROUND | |||||

| Hope Brook | Cut-off Grade (g/t Au) |

Tonnes | Grade (Au g/t) |

Contained Gold Ounces |

|

| INDICATED | |||||

| 240 Zone | 2.0 | 544,000 | 4.31 | 75,000 | |

| Main Zone | 0.5 and 2.0 | 15,646,000 | 2.25 | 1,131,000 | |

| INFERRED | |||||

| 240 Zone | 2.0 | 1,994,000 | 3.28 | 210,000 | |

| Main Zone | 2.0 | 221,000 | 2.96 | 21,000 | |

Notes:

- The classification of the current Mineral Resource Estimate into Indicated and Inferred is consistent with current 2014 CIM Definition Standards - For Mineral Resources and Mineral Reserves

- All figures are rounded to reflect the relative accuracy of the estimate.

- All resources are presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The update MRE is based on data for 763 surface and underground drill holes representing 164,865 m of drilling, including data for 60 surface drill holes for 19,090 m completed by Big Ridge in 2021 and 2022.

- The mineral resource estimate is based on 2 three-dimensional ("3D") resource models for the Main Zone and 240 Zones.

- High grade capping was applied to the 1.5 m composite data. A capping value of 50 g/t Au was to the Main Zone and 40 g/t Au for the 240 Zone.

- Average density values were assigned per zone.

- Gold is estimated for each mineralization domain. Blocks (5x5x5) within each mineralized domain were interpolated using 1.5 metre capped composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains.

- It is envisioned that parts of the Main Zone may be mined using open pit mining methods. Open pit mineral resources are reported at a base case cut-off grade of 0.4 g/t Au within a conceptual pit shell.

- It is envisioned that parts of the Main Zone as well as the 240 Zone may be mined using underground mining methods. A selected base case cut-off grade of 2.0 g/t Au is used to determine the underground mineral resource for the Main Zone and 240 Zone.The underground Mineral Resource grade blocks were quantified above the base case cut-off grade, below the constraining pit shell and within the constraining mineralized wireframes.

- Base case cut-off grades consider a metal price of US$1750.00/oz Au and considers a metal recovery of 86 % for Au.

- The pit optimization and in-pit base case cut-off grade of 0.4 g/t Au considers a mining cost of US$2.65/t rock and processing, treatment and refining, transportation and G&A cost of US$15.60/t mineralized material, and an overall pit slope of 55°. The underground base case cut-off grade of 2.0 g/t Au considers a mining cost of US$54.00/t rock and processing, treatment and refining, transportation and G&A cost of US$15.550. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The results from the pit optimization are used solely for the purpose of testing the "reasonable prospects for economic extraction" by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. There is no certainty that all or any part of the Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration. There is no other relevant data or information available that is necessary to make the technical report understandable and not misleading.

- The Author is not aware of any known mining, processing, metallurgical, environmental, infrastructure, economic, permitting, legal, title, taxation, socio-political, or marketing issues, or any other relevant factors not reported in this technical report, that could materially affect the updated MRE.

For further information on the updated Hope Brook MRE refer to Big Ridge Gold Corp’s technical report titled “Mineral Resource Estimate Update for the Hope Brook Gold Project, Newfoundland and Labrador, Canada”, prepared by SGS Geological Services Ltd, and dated April 6, 2023, which is available under Big Ridge’s SEDAR profile at www.sedar.com

To view images representing the Hope Brook Mineral Resource Model please click on the following link: : https://bigridgegold.com/site/assets/files/5585/2023_hb_mre_slides_for_press_release.pdf?v=063010?v=1711667214?v=0.286?v=0.785