News Releases

First Mining Consolidates Strategic Land Position at Cameron Gold Project

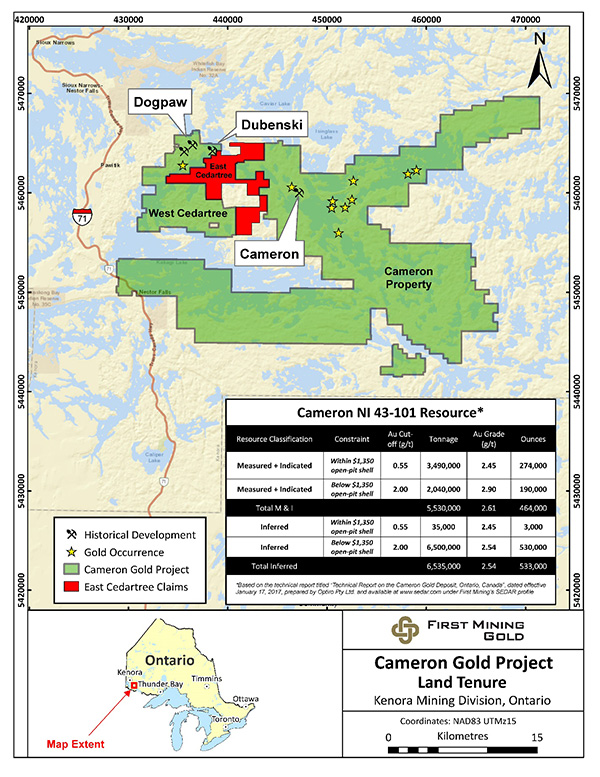

December 3, 2020 – Vancouver, Canada – First Mining Gold Corp. (“First Mining” or the “Company”) (TSX: FF) (OTCQX: FFMGF) (FRANKFURT: FMG) is pleased to announce that it has entered into an agreement with Metalore Resources Limited (“Metalore”) (TSX.V: MET) pursuant to which First Mining will purchase the East Cedartree claims from Metalore, filling in a strategic piece in First Mining landholdings near the Cameron Gold Project (“Cameron” or the “Project”) located 80 km southeast of the city of Kenora in northwestern Ontario.

Under the transaction, First Mining will acquire the East Cedartree claims by paying $3 million in cash to Metalore and issuing 3 million First Mining shares to Metalore. The transaction is expected to close on December 9, 2020. The East Cedartree claims contain an existing mineral resource estimate that was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and encompass a highly favourable geological setting for new gold discoveries in close proximity to the existing known deposits at the Company’s Cameron and West Cedartree properties.

Highlights:

- The additional mineral claims are located between two non-contiguous claim blocks - the Cameron Property, which includes the “Cameron Gold Deposit” that hosts the current NI 43-101 Mineral Resource and the West Cedartree Property, which includes the Dubenski and Dogpaw deposits - therefore substantially consolidate First Mining’s Cameron Gold Project into a single contiguous block

- The East Cedartree claims add a strategic 3,200 hectares of prospective mineral tenure in the middle of the Cameron land package, adding to the 49,600 hectares that First Mining already holds in the district

- The East Cedartree claims host an Indicated Mineral Resource of 2.1 Mt at 1.36 g/t Au containing 93,000 ounces of gold and an Inferred Mineral Resource of 2.2 Mt at 1.36 g/t Au containing 95,300 ounces of gold (at a cut-off of 0.3 g/t gold) (based on the Technical Report titled “Gold Exploration Potential & Preliminary Resource Estimate, East Cedartree Lake Mining Claims, Kenora Mining District, Northwestern Ontario”, dated effective March 12, 2012, which is available at www.sedar.com under Metalore’s SEDAR profile)

- The Cameron Gold Project benefits from excellent infrastructure, including year-round road access to the property, and the main resource areas sit within 200 m of existing forestry roads

“We are very excited with the acquisition of the East Cedartree claims” stated Dan Wilton, CEO of First Mining. “The acquisition consolidates a strategic part of our district-scale Cameron Gold Project and adds immediately accretive resources to the project. We are currently undertaking prioritization and review of the numerous exploration targets at Cameron while we advance discussions with our local Indigenous communities, and hope to commence a drill program in 2021.”

About the East Cedartree Property

The East Cedartree property is located approximately 80 km southeast of the city of Kenora, and 15 km east of the village of Sioux Narrows in northwestern Ontario. The property consists of 212 mining claims, which cover over 3,200 hectares, and hosts a number of gold showings, shear zones, and sulphide rich-areas, many of which have never been drilled.

In 2002, Metalore acquired the property from Avalon Ventures Ltd. and spent $2.8 M to acquire additional claims, selectively prospect and sample, conduct geophysical surveys (magnetic survey, VLF, electro-magnetic and IP) and drill 95 holes (12,947 m) throughout the property from 2002 to 2010. Significant gold intersections include 46.8 m at 4.51 g/t Au (drill hole MC-02-05), 18.8 m at 5.44 g/t Au (drill hole MC-02-13) and 50.9 m at 2.97 g/t Au (drill hole MC-02-17).

This exploration work resulted in the publication of a mineral resource estimate in 2012 that was prepared in accordance with NI 43-101. A total of seven sub-parallel gold mineralized corridors of higher-grade gold mineralization along with a main zone were defined within a larger envelope of lower grade gold mineralization that could potentially be incorporated into a “bulk mining” structure. A cut-off of 0.3 g/t Au was used to define a lower grade envelope and cut-offs of 1.0 g/t and 3.0 g/t Au were used to define higher grade sections. At a cut-off of 0.3 g/t Au, an Indicated Resource was calculated of 2.1 million tonnes at 1.36 g/t Au totalling 92,950 ounces of gold, plus an Inferred Resource of 2.2 million tonnes at 1.36 g/t Au for a total of 95,280 ounces of gold.

*Resource figures based on the technical report titled “Gold Exploration Potential & Preliminary Resource Estimate, East Cedartree Lake Mining Claims, Kenora Mining District, Northwestern Ontario”, dated effective March 12, 2012, which is available at www.sedar.com under Metalore’s SEDAR profile.

Notes:

- Results are presented undiluted and in-situ; some blocks may be locked in pillars.

- A minimum 1.5 m true width was applied.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is currently insufficient exploration to define these Inferred mineral resources as Indicated or Measured mineral resources and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured mineral resource category.

Plan map showing the location of the Cameron project and the East Cedartree claims:

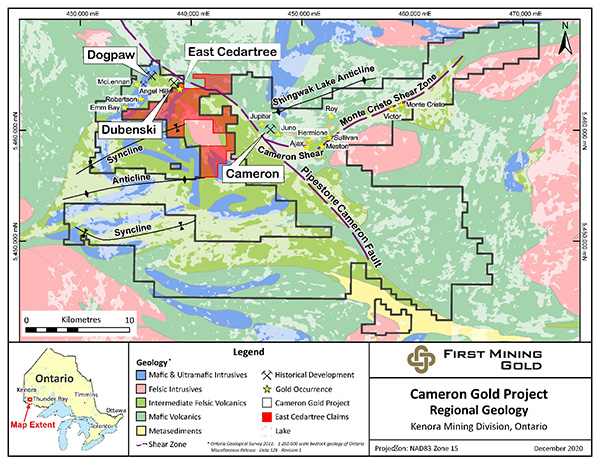

Plan map showing the regional geology of the Cameron Gold Project:

About the Cameron Gold Project

The Cameron Gold Project consists of a district-scale, 496 square kilometre land package encompassing the Cameron Gold Deposit, the West Cedartree deposits (including Dubenski and Dogpaw) and several other highly prospective gold showings. The Cameron Gold Deposit covers prospective areas of the Cameron Lake Shear Zone (“CLSZ”), a northwest trending shear zone which dips steeply to the northeast. The CLSZ is itself a splay from a large, regional crustal-scale structure called the Cameron-Pipestone Fault. The mineralization at the Cameron Gold Deposit comprises a number of sub-parallel lodes which commonly occur in the upper part of the CLSZ or in the structural hanging wall to the CLSZ. Gold mineralization mainly consists of disseminated sulphide replacements, quartz-sulphide stockwork and quartz breccia veins.

The Cameron Gold Deposit has been explored by surface and underground drilling and by underground bulk sample. Mineralization remains open at depth and along strike to the northwest with potential to expand the mineral resource in these directions.

The 2017 mineral resource estimate for Cameron is presented below:

| Mineral Resource Classification | Open-Pit Constraint | Cut-off Au Grade (g/t) | Tonnes | Au Grade (g/t) | Contained Au (oz) |

| Measured Mineral Resource | Within $1,350 open-pit shell | 0.55 | 2,670,000 | 2.66 | 228,000 |

| Indicated Mineral Resource | Within $1,350 open-pit shell | 0.55 | 820,000 | 1.74 | 46,000 |

| Measured + Indicated | 3,490,000 | 2.45 | 274,000 | ||

| Mineral Resource Classification | Underground Constraint | Cut-off Au Grade (g/t) | Tonnes | Au Grade (g/t) | Contained Au (oz) |

| Measured Mineral Resource | Below $1,350 open-pit shell | 2.00 | 690,000 | 3.09 | 69,000 |

| Indicated Mineral Resource | Below $1,350 open-pit shell | 2.00 | 1,350,000 | 2.80 | 121,000 |

| Measured + Indicated | 2,040,000 | 2.90 | 190,000 | ||

| Total Measured + Indicated | 5,530,000 | 2.61 | 464,000 |

| Mineral Resource Classification | Open-Pit Constraint | Cut-off Au Grade (g/t) | Tonnes | Au Grade (g/t) | Contained Au (oz) |

| Inferred Mineral Resource | Within $1,350 open-pit shell | 0.55 | 35,000 | 2.45 | 3,000 |

| Mineral Resource Classification | Underground Constraint | Cut-off Au Grade (g/t) | Tonnes | Au Grade (g/t) | Contained Au (oz) |

| Inferred Mineral Resource | Below $1,350 open-pit shell | 2.00 | 6,500,000 | 2.54 | 530,000 |

| Total Inferred | 6,535,000 | 2.54 | 533,000 |

Notes:

- Based on the technical report titled “Technical Report on the Cameron Gold Deposit, Ontario, Canada”, dated effective January 17, 2017, which is available at www.sedar.com under First Mining’s SEDAR profile.

- The mineral resource estimate is classified as Measured, Indicated and Inferred mineral resources.

- 2014 CIM Definition Standards were followed for classification of mineral resources.

- The mineral resource has been estimated using a gold price of US$1,350/oz.

- The mineral resource was estimated using a block model. Three dimensional wireframes were generated using geological information. The ordinary kriging estimation method was used to interpolate grades into blocks. Blocks were sub-blocked to more accurately reflect the volume of the wireframes.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is currently insufficient exploration to define these Inferred mineral resources as Indicated or Measured mineral resources and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured mineral resource category.

- Numbers may not add due to rounding.

- The mineral resource for the Cameron Gold Project does not include the mineralized material from the Dubenski and Dogpaw areas.

Historical Exploration and Development

Exploration in the project area commenced in the 1940s and continued until 2015, with numerous companies completing prospecting, line cutting, geological mapping, trenching, soil, till and outcrop sampling, surface and underground drilling, underground development, and geophysical surveys including ground magnetic and electromagnetic (EM) and Induced Polarisation (IP), airborne magnetic and Versatile Time-domain Electromagnetic (VTEM). The Cameron Gold Project comprises both the Cameron property (hosting the Cameron Gold Deposit) and the West Cedartree property (hosting the Dogpaw and Dubenski Deposits).

Cameron Property

On the Cameron Gold Deposit, the first drilling was undertaken in 1960. Prior to First Mining purchasing the project in 2016, there were 1,078 holes comprising in excess of 125,000 m of diamond drill core drilled by seven companies. In 1987, underground development, including an exploration decline ramp extending 209 m below surface to the 685 level, was completed to allow access for underground exploration and approximately 65,000 m3 of material was excavated and bulk sampling, diamond drilling and rock chip sampling were completed. Despite the mining of mineralized material for testing purposes, no production was ever undertaken. In 2014, Chalice Gold Mines carried out diamond drilling at several prospects proximal to the Cameron Gold Deposit, with 15 holes for 2,600 m drilled at the Jupiter, Ajax, Juno and Hermione prospects.

West Cedartree Property

The Company’s West Cedartree property includes the Dubenski and Dogpaw gold deposits, as well as other identified gold prospects. Numerous underground workings (mainly shafts) have been excavated at West Cedartree, and a significant amount of drilling completed, as detailed below. Internal historical mineral resource estimates for the Dubenski and Dogpaw Gold Deposits were reported by Chalice in 2015.

Dubenski Deposit

The Dubenski Deposit has been explored by drilling from surface and from adjacent underground development, and includes a total of 272 diamond drillholes (30,674.3 m) which were completed in nine drilling campaigns by previous explorers between 1936 and 2010. The gold mineralization is concentrated within the Dubenski Shear Zone (DSZ), a vertically-dipping shear structure which has been traced for a strike length of approximately 915 m. Visible gold is common throughout the deposit. The mineralization as modelled occurs over a 400 m strike length, to a depth of 200 m below surface and ranges between 5 and 25 m in true thickness, averaging 15 m, and remains open in all directions.

Dogpaw Deposit

The Dogpaw Deposit comprises ten identified vein sets that extend over a strike of 350 m and to a vertical depth of 210 m. Gold mineralization occurs mainly in gabbro at the contact with mafic volcanic rocks where porphyry intrusions are apparently localized by a series of northwest-trending faults. The mineralization varies in thickness considerably, ranging from 30 cm to more than 5 m, with an average width of 2 to 3 m. A total of 235 drill holes totalling 19,597 m were completed on the Dogpaw Deposit in six drilling programs. In 1995, an open pit excavation was undertaken at the Dogpaw Gold Deposit to generate a bulk sample.

Several other prospects on the West Cedartree property have been drilled, namely McLennan, Angel Hill, Robertson and Emm Bay. An internal mineral resource estimate has been undertaken for the Angel Hill prospect.

Historical Work on the East Cedartree Property

Avalon Ventures Ltd. carried out systematic gold exploration covering the area of the present East Cedartree property during 1997 and 1998, including geophysical surveys, prospecting/mapping, and diamond drilling which led to the original gold discovery hole on the property while testing Induced Polarization (I.P.) and geochemical anomalies. Between 2002 and 2010, Metalore conducted further exploration work on the property, including geophysical surveys, stripping, prospecting and surface diamond drilling.

In 2018, Metalore completed an additional prospecting, sampling and trenching program primarily to extend the drill-tested 75-metre wide gold corridor to the southeast at surface. This work resulted in the discovery of a new area of mineralized altered granodiorite which yielded surface gold values up to 4.3 g/t and established a new drill target at East Cedartree.

The East Cedartree property is located to the south of the Pipestone-Cameron Deformation Zone. Gold mineralization is associated with late structures, plus strong ankerite, sericite, silica, chlorite and pyrite alteration.

About the Cameron Gold Project

The Cameron Gold Project is 100% owned by First Mining and was acquired by the Company from Chalice Gold Mines on June 9, 2016. The project, which covers an area of over 49,000 hectares, is located in northwestern Ontario, approximately 80 kilometres southeast of Kenora.

Qualified Person

Hazel Mullin, P.Geo., Director, Data Management and Technical Services of First Mining, is a “Qualified Person” for the purposes of NI 43-101, and she has reviewed and approved the scientific and technical disclosure contained in this news release.

About First Mining Gold Corp.

First Mining is a Canadian gold developer focused on the development and permitting of the Springpole Gold Project in northwestern Ontario. Springpole is one of the largest undeveloped gold projects in Canada, currently hosting a mineral resource base of 4.67 million ounces of gold in the Indicated category and 0.23 million ounces of gold in the Inferred category1. A Pre-Feasibility Study is underway, with completion targeted in early 2021, and permitting is on-going with submission of the Environmental Impact Statement targeted for 2021. The Company also holds a large equity position in Treasury Metals Inc. who are advancing the Goliath-Goldlund gold projects towards construction. First Mining’s portfolio of gold projects in eastern Canada also includes the Pickle Crow (being advanced in partnership with Auteco Minerals Ltd.), Cameron, Hope Brook, Duparquet, Duquesne, and Pitt gold projects.

First Mining was created in 2015 by Mr. Keith Neumeyer, founding President and CEO of First Majestic Silver Corp.

ON BEHALF OF FIRST MINING GOLD CORP.

Daniel W. Wilton

Chief Executive Officer and Director

For further information, please contact:

Spiros Cacos | Vice President, Investor Relations

Direct: +1 604 639 8825 | Toll Free: 1 844 306 8827 | Email: info@firstmininggold.com

www.firstmininggold.com

Note:

1. These numbers are from the independent technical report titled “Preliminary Economic Assessment Update for the Springpole Gold Project, Ontario, Canada”, dated November 5, 2019, which was prepared by SRK Consulting (Canada) Inc. in accordance with NI 43-101 and is available at www.sedar.com under First Mining’s SEDAR profile. Readers are cautioned that the PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain "forward-looking information” and "forward-looking statements” (collectively "forward-looking statements”) within the meaning of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date of this news release. Forward-looking statements are frequently, but not always, identified by words such as "expects”, "anticipates”, "believes”, “plans”, “projects”, "intends”, "estimates”, “envisages”, "potential”, "possible”, “strategy”, “goals”, “objectives”, or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions.

Forward-looking statements in this news release relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) closing of the transaction with Metalore being completed by December 9, 2020; (ii) the Company commencing a drill program at the Cameron Gold Project in 2021; (iii) the potential to increase the amount of mineral resources at the Cameron Gold Project through future drilling; (iv) timing for the completion of a Pre-Feasibility Study for Springpole; (v) timing for the submission of an Environmental Impact Statement for Springpole; (vi) the Company’s focus on advancing its assets towards production; and (vii) realizing the value of the Company’s gold projects for the Company’s shareholders. All forward-looking statements are based on First Mining's or its consultants' current beliefs as well as various assumptions made by them and information currently available to them. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation the Company’s business, operations and financial condition potentially being materially adversely affected by the outbreak of epidemics, pandemics or other health crises, such as COVID-19, and by reactions by government and private actors to such outbreaks; risks to employee health and safety as a result of the outbreak of epidemics, pandemics or other health crises, such as COVID-19, that may result in a slowdown or temporary suspension of operations at some or all of the Company's mineral properties as well as its head office; fluctuations in the spot and forward price of gold, silver, base metals or certain other commodities; fluctuations in the currency markets (such as the Canadian dollar versus the U.S. dollar); changes in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins and flooding); the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities, indigenous populations and other stakeholders; availability and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development; title to properties.; and the additional risks described in the Company’s Annual Information Form for the year ended December 31, 2019 filed with the Canadian securities regulatory authorities under the Company’s SEDAR profile at www.sedar.com, and in the Company’s Annual Report on Form 40-F filed with the SEC on EDGAR.

First Mining cautions that the foregoing list of factors that may affect future results is not exhaustive. When relying on our forward-looking statements to make decisions with respect to First Mining, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. First Mining does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by the Company or on our behalf, except as required by law.

Cautionary Note to United States Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this news release have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum 2014 Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and mineral resource and reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term "resource” does not equate to the term "reserves”. Under U.S. standards, mineralization may not be classified as a "reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC's disclosure standards normally do not permit the inclusion of information concerning "measured mineral resources”, "indicated mineral resources” or "inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute "reserves” by U.S. standards in documents filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. U.S. investors should also understand that "inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an "inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated "inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an "inferred mineral resource” exists or is economically or legally mineable. Disclosure of "contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of "reserves” are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as "reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.