Updating PEA and Advancing Permitting at the Springpole Gold Project

Drilling at Goldlund Gold Project to Follow Up on Successful 2018 Exploration Program

June 12, 2019 – Vancouver, BC – First Mining Gold Corp. (“First Mining” or the “Company”) (TSX: FF) (OTCQX: FFMGF) (FRANKFURT: FMG) is pleased to announce the commencement of work programs to advance its Canadian gold asset portfolio. The Company’s Springpole and Goldlund projects in Ontario are the primary focus, with most of the funding dedicated to the advancement of these two strategic assets.

Daniel W. Wilton, First Mining’s CEO, stated, “On the back of our upsized equity financing, we are excited to commence our work program to advance our portfolio of high-quality Canadian gold assets. The primary focus is to advance and de-risk our Springpole and Goldlund gold projects, both located in northwestern Ontario, a very well-known and prolific mining district. We believe an updated PEA at Springpole will provide the market with a better understanding of this strategic asset’s value potential and annual production capability under an optimized flowsheet as a result of our successful metallurgical studies. Goldlund will be advanced via further drilling, as we continue to work towards unlocking this large district’s potential. We are excited to showcase the significant value that exists within our strategic portfolio of high-quality assets.”

At Springpole, the goal in 2019 is to update the current Preliminary Economic Assessment (“PEA”)1 and continue to advance permitting. The updated PEA will reflect updated metal recoveries, capital cost and operating cost estimates from the revised process flow sheet, incorporating flotation and fine grinding as described in First Mining’s February 19, 2019 press release. First Mining believes that incorporating the increased recoveries will further position the project as a “Tier 1” asset among gold development projects in Canada.

At Goldlund, the focus in 2019 is to follow up on the successful 2018 regional drill program by continuing step-out drilling at the Miller prospect and to continue to define the broader regional potential of the project. An initial 3,000 metre step-out drill program at Miller is planned to commence this month. Further drilling in 2019 along the 50-kilometre strike length of the geological structures will be determined after this initial step-out phase.

Regarding First Mining’s broader gold asset portfolio, including the Pickle Crow, Hope Brook and Cameron projects, the priority is to complete low-spend, incremental work to continue to de-risk these assets, including baseline environmental studies, internal scoping studies and potential reconnaissance mapping and exploration work.

Springpole Gold Project (Ontario, Canada)

The near-term priority at Springpole is to complete an updated PEA that incorporates the most recent metallurgical work that was completed on the project during 2018 and 2019. The positive interim metallurgical test results, announced on February 19, 2019, indicate the potential for a significant increase in recoveries for both gold and silver. Total recoveries achieved through flotation followed by separate cyanide leaching of both concentrate and flotation tails were 90.6% for gold and 95.1% for silver (compared with 80% for gold and 85% for silver in the 2017 Springpole PEA)2. The revised PEA will also incorporate updated capital and operating cost estimates to reflect this updated flow sheet.

The on-going priority at Springpole is to continue to advance the project through the provincial and federal environmental assessment (“EA”) processes. The goal is to prepare a synchronized Environmental Impact Statement (“EIS”) that meets the federal and provincial requirements.

The federal EA process was initiated through the submission of a Project Description (“PD”) to the Canadian Environmental Assessment Agency (“CEAA”) in February 2018. The PD was used by CEAA to determine whether an EA was required for the Springpole project, and to prepare guidelines regarding the completion of an EA. EIS guidelines were issued to First Mining on June 19, 2018.

For the provincial process, First Mining entered into a Voluntary Agreement with the Ontario Ministry of Environment, Conservation and Parks (“MECP”) (formerly MOECC) in April 2018 to conduct an EA for the project. There are two main stages in the provincial EA process, namely the development of Terms of Reference (“ToR”) and the development of the EA Report. The ToR is a work plan which will outline how the EA will be prepared. The ToR document will address the community consultation and engagement plan, key components of the project, and the range of alternatives that will be considered by First Mining.

First Mining commenced community consultation and engagement with the Communities of Interest (“COI”) in July 2018 and has held consultation meetings with Indigenous communities and other stakeholders. The Company is now in its second round of consultation in readiness for the preparation of the ToR. First Mining anticipates completing this round of consultation and submitting its ToR to MECP during the third quarter of 2019, with final approval of its ToR anticipated by the end of 2019.

While the permitting process is ongoing, the Company has completed a “data gap assessment” on the environmental baseline work to identify any remaining work requirements. Data collection programs to further advance the environmental assessment process will include terrestrial and aquatic environs, hydrology, surface water quality monitoring, hydrogeology, geotechnical investigation, and tailings and mine rock geochemical characterization.

The Company plans to complete its draft EIS during the balance of 2019 and 2020, with a goal of submitting a final EIS in early 2021.

Goldlund Gold Project (Ontario, Canada)

The immediate priority at Goldlund is to follow up on regional exploration, focused at the Miller prospect, which is located along strike 10 kilometres northeast of the main Goldlund deposit. The 2018 drill campaign at the Miller prospect yielded strong results, including 108 metres of 2.43 g/t gold (see news release dated March 27, 2019 for final Miller results).

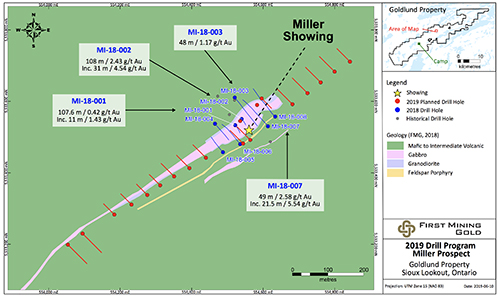

An initial 3,000 metre step-out drill program is planned at the Miller prospect, following up on the strong results achieved in 2018. The Company expects drill rigs to be mobilized to the Goldlund site in June 2019. The program consists of 14 drill holes planned along strike both to the northeast and southwest of the area drilled in 2018 along 50 metre to 200 metre centres, testing a total strike length of up to 900 metres. This initial program will also include five infill drill holes to support the potential delineation of an NI 43-101 compliant resource estimate at the Miller prospect. The balance of the program will be success dependent, with additional metres available to continue methodically testing the strike extent of the Miller prospect as well as for infill drilling.

Plan map showing the proposed drill locations as well as prior drill locations at the Miller Prospect

(click the picture for a high quality version of the map)

None of the 2018 drill results from the Miller prospect were incorporated into the 2019 updated mineral resource estimate for Goldlund, and as such, step-out and infill drilling at Miller is a priority work program in 2019 with a goal of establishing an initial resource estimate for the Miller prospect.

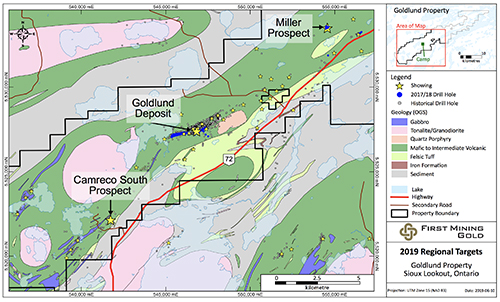

Drilling will also be completed to test the Camreco South target, another regional target at Goldlund. The granodiorite that hosts the Goldlund main deposit has been mapped at surface approximately seven kilometres southwest of the Goldlund main zone along the main structural corridor. Only a limited amount of historical work has been completed on the Camreco South showing. This includes soil sampling, surface grab sampling and a limited amount of historical drilling in the area, including one drill hole (TFY-28) that yielded visible gold and a high-grade intercept of 13.87 g/t gold over 1.34 metres.

Plan map showing the location of the Goldlund, Miller and Camreco South targets

(click the picture for a high quality version of the map)

Broader Gold Project Portfolio (Eastern Canada)

First Mining’s broader asset portfolio includes strategic, past-producing gold assets located in Ontario, Quebec and Newfoundland. Efforts on the broader portfolio will focus on the Pickle Crow, Hope Brook and Cameron gold projects, and will include data compilation, internal scoping studies, reconnaissance exploration programs and baseline environmental work. This work will advance the Company’s understanding of the potential of each of the projects, while ensuring that thorough and appropriate baseline environmental data is being collected in order to facilitate permitting processes in the future. Each of these projects have well-defined resources, excellent infrastructure and a significant amount of historical data.

Company Update

First Mining completed a non-brokered equity offering in mid-May 2019, raising $7.4 million with net proceeds primarily dedicated towards exploration, development and permitting activities at the Company’s Canadian gold projects. First Mining is fully funded to complete the work programs outlined in this news release for its Canadian gold assets. The Company is focused on continuing to advance and de-risk its strategic portfolio of Canadian gold assets, with a goal of surfacing fundamental value in its portfolio and unlocking value for all stakeholders.

Qualified Person

Hazel Mullin, P.Geo., Director, Data Management and Technical Services of First Mining, is a “qualified person” for the purposes of NI 43-101, and she has reviewed and approved the scientific and technical disclosure contained in this news release.

About First Mining Gold Corp.

First Mining Gold Corp. is an emerging development company with a diversified portfolio of gold projects in North America. Having assembled a large resource base of 7.3 million ounces of gold in the Measured and Indicated categories and 3.6 million ounces of gold in the Inferred category in mining friendly jurisdictions of eastern Canada, First Mining is now focused on advancing its material assets towards a construction decision and, ultimately, to production. The Company currently holds a portfolio of 24 mineral assets in Canada, Mexico and the United States, and may acquire additional mineral assets in the future.

ON BEHALF OF FIRST MINING GOLD CORP.

Daniel W. Wilton

Chief Executive Officer and Director

For further information, please contact:

Mal Karwowska | Vice President, Corporate Development & Investor Relations

Direct: 604.639.8824 | Toll Free: 1.844.306.8827 | Email: info@firstmininggold.com

www.firstmininggold.com

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain "forward-looking information” and "forward-looking statements” (collectively "forward-looking statements”) within the meaning of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date of this news release. Forward-looking statements are frequently, but not always, identified by words such as "expects”, "anticipates”, "believes”, “plans”, “projects”, "intends”, "estimates”, “envisages”, "potential”, "possible”, “strategy”, “goals”, “objectives”, or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions.

Forward-looking statements in this news release relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) timing for the completion of an updated PEA for the Company’s Springpole gold project, and the Company’s belief that such updated PEA will provide the market with a better understanding of the value potential and annual production capability of Springpole; (ii) the Company’s goal of preparing a synchronized EIS that meets the federal and provincial EA requirements; (iii) timing for the receipt by the Company of the final approved ToR; (iv) timing regarding the completion by the Company of the draft EIS during the balance of 2019 and 2020, and the submission of the final EIS in early 2021; (v) the Company’s expectation that drill rigs will be mobilized to the Goldlund project site in June 2019; (vi) the Company’s goal of delineating an initial resource estimate for the Miller prospect on the Goldlund property; (vii) the data compilation, internal scoping studies, reconnaissance exploration programs and baseline environmental work that the Company plans to carry out at its Pickle Crow, Hope Brook and Cameron projects; (viii) the Company’s focus on advancing its material assets towards production; and (iv) realizing and unlocking the value of the Company’s gold projects for the Company’s shareholders. All forward-looking statements are based on First Mining's or its consultants' current beliefs as well as various assumptions made by them and information currently available to them. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the presence of and continuity of metals at Springpole and Goldlund at estimated grades; success in realizing proposed drilling programs; fluctuations in the spot and forward price of gold, silver, base metals or certain other commodities; fluctuations in the currency markets (such as the Canadian dollar versus the U.S. dollar); changes in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration and exploration drilling programs, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins and flooding); the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities, indigenous populations and other stakeholders; availability and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development; title to properties.; and the additional risks described in the Company’s Annual Information Form for the year ended December 31, 2018 filed with the Canadian securities regulatory authorities under the Company’s SEDAR profile at www.sedar.com, and in the Company’s Annual Report on Form 40-F filed with the SEC on EDGAR.

First Mining cautions that the foregoing list of factors that may affect future results is not exhaustive. When relying on our forward-looking statements to make decisions with respect to First Mining, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. First Mining does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by the Company or on our behalf, except as required by law.

Cautionary Note to United States Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy, and Petroleum 2014 Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and mineral resource and reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term "resource” does not equate to the term "reserves”. Under U.S. standards, mineralization may not be classified as a "reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC's disclosure standards normally do not permit the inclusion of information concerning "measured mineral resources”, "indicated mineral resources” or "inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute "reserves” by U.S. standards in documents filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. U.S. investors should also understand that "inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an "inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated "inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an "inferred mineral resource” exists or is economically or legally mineable. Disclosure of "contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of "reserves” are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as "reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

1 The current technical report on the project entitled “Preliminary Economic Assessment Update for the Springpole Gold Project, Ontario, Canada”, which is dated October 16, 2017, was prepared by SRK Consulting (Canada) Inc. in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) (the “2017 Springpole PEA”).

2 Readers are cautioned that the 2017 Springpole PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2017 Springpole PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Actual results may vary, perhaps materially. The Company is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing or other issue which may materially affect this estimate of mineral resources. The projections, forecasts and estimates presented in the 2017 Springpole PEA constitute forward-looking statements and readers are urged not to place undue reliance on such forward-looking statements. Additional cautionary and forward-looking statement information is detailed at the end of this news release.