Project Overview:

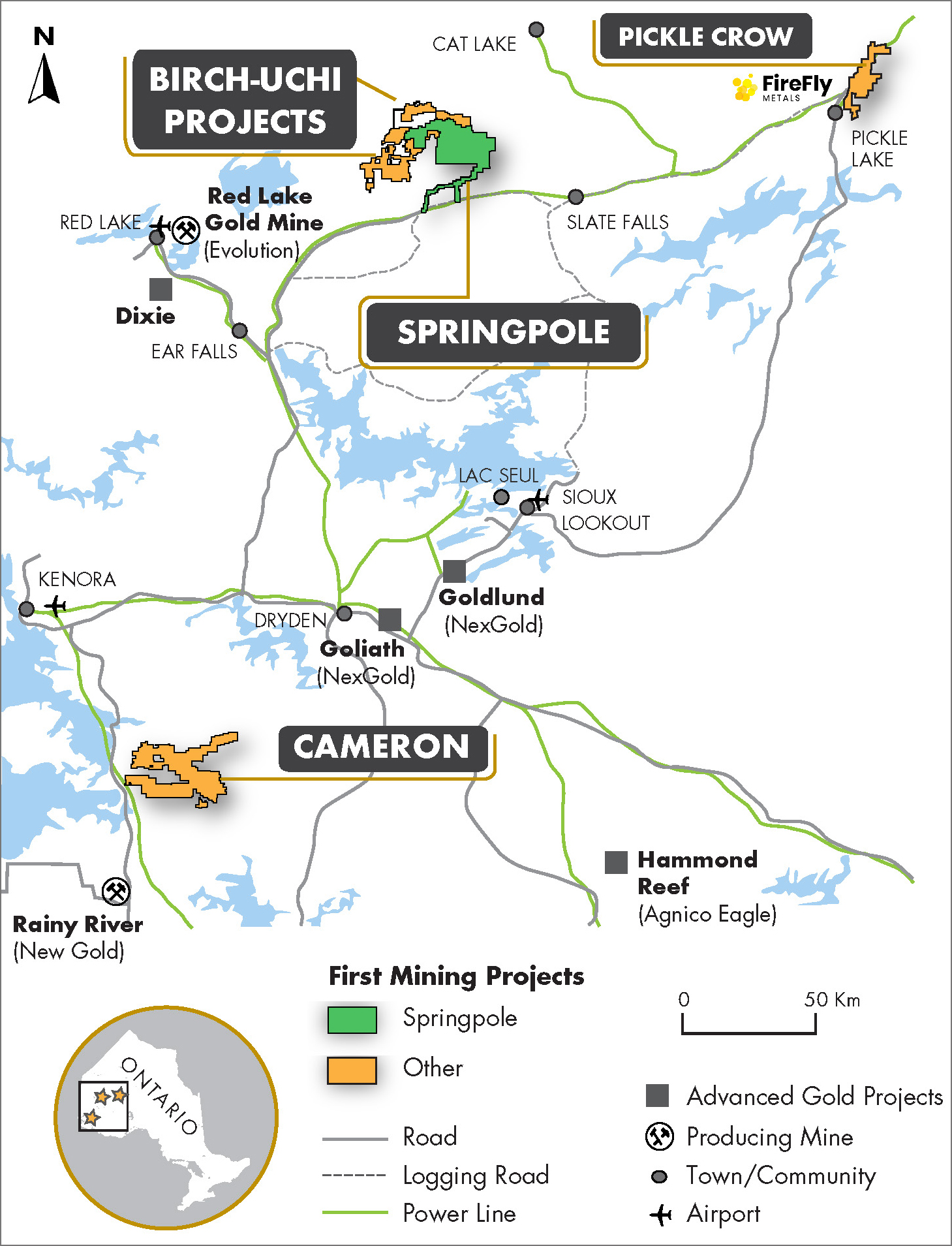

The Springpole Gold Project is located in northwestern Ontario on an area of approximately 800 hectares. The broader project land package covers an area of 41,943 hectares and consists of 30 patented mining claims, 282 mining claims and thirteen mining leases. The project is located approximately 110 kilometres northeast of the Municipality of Red Lake in northwestern Ontario and is situated within the Birch-Uchi Greenstone Belt. The large, open pit resource is supported by significant infrastructure, including an onsite camp, winter road access, a logging road within 18 km of the camp, and nearby power lines within 40 km.

With 191 Mt at 0.78 g/t Au and 4.6 g/t Ag, totalling 4.8 million ounces of gold and 28 million ounces of silver in the Indicated Mineral Resource category, and 64 Mt at 0.38 g/t Au and 3.1 g/t Ag, totalling 0.8 million ounces of gold and 6.5 million ounces of silver in the Inferred Mineral Resource category, the Springpole Gold Project is one of the largest undeveloped gold projects in Ontario.

Birch Uchi Greenstone Belt Project:

The Birch-Uchi Greenstone Belt Project (“BUGB Project”) represents regional scale exploration opportunities that have been consolidated by First Mining surrounding the Springpole Project. This land tenure coupled with the Springpole Project, also located in the Birch-Uchi Greenstone Belt, consists of >70,000 hectares and presents a strong opportunity for new discoveries in an area that is historically underexplored and has only seen a fraction of the exploration work that has been done in the neighbouring Red Lake and Pickle Lake greenstone belts that have been subject to earlier consolidation and discovery cycles.

The BUGB Project hosts significant geologic elements, including historic production centres that are demonstrative of a strong gold endowment and affinity for new discovery. First Mining’s extensive BUGB property position is located within the Red Lake Mining District and is situated approximately 80 km east of the Red Lake Mines Complex of Evolution Mining and 75 km northeast of Kinross Gold’s Dixie Project (formerly owned by Great Bear Resources Ltd). The geology of the region is comprised of Archean Greenstone terranes that are endowed by significant gold mineralization inclusive of orogenic and alkaline intrusion related deposit styles. Initial data compilation and validation to date has indicated that the region demonstrates an underexplored and previously fragmented exploration immaturity that is well levered to the Company’s strategy of consolidation and district screening.

First Mining has initiated district-scale screening of the Birch-Uchi Project area through a multi-phase commitment to explore and enhance mineral potential within the region.

Project Highlights:

One of the largest, undeveloped, open-pit gold deposits in Canada

- Reserves of 3.1 million ounces gold at 0.94 g/t, 16 million ounces of silver at 4.9 g/t

- Average annual gold production of 330,000 ounces in years 1 through 5

Positive Economics

- PFS announced November 2025, post-tax NPV5% of US$2.1 billion and post-tax IRR of 41%

Tier 1 Mining Jurisdiction

- Long history of gold production in the area

Unique Strategic Gold Asset

- One of the few projects in Canada able to produce more than 300,000 oz per year

Existing Infrastructure in Place

- 34-person exploration camp, winter road access, a logging road within 18 km of the camp, and nearby power lines within 40 km

2025 Pre-Feasibility Study (PFS) Highlights:

The PFS contemplates an open pit mine and milling operation, evaluating recovery of gold and silver from a 30,000 tonne-per-day operation.

Note: Further details are in the “Springpole Gold Project NI 43-101 Technical Report and Pre-Feasibility Study, Ontario, Canada ” dated December 19, 2025, prepared for First Mining by Ausenco Engineering Canada ULC and available under First Mining’s SEDAR+ profile at www.sedarplus.ca.

Key 2025 PFS highlights include:

- US$3.2 billion pre-tax net present value at a 5% discount rate (“NPV5%”) at US$3,100/oz gold (“Au”), increasing to US$5.6 billion at US$4,200/oz Au

- US$2.1 billion after-tax NPV5% at US$3,100/oz Au, increasing to US$3.8 billion at US$4,200/oz Au

- 54% pre-tax internal rate of return (“IRR”); 41% after-tax IRR at US$3,100/oz Au increasing to 63% after-tax IRR at US$4,200/oz Au

- Life of mine (“LOM”) of 9.4 years

- After-tax payback of 1.8 years and reducing to 1.2 years at US$4,200/oz Au

- Initial capital costs estimated at US$1,104 million, sustaining capital costs estimated at US$323 million, plus US$40 million in closure costs (excluding plant closure)

- Average annual payable gold production of 330 koz per year (Years 1 to 5); 281 koz per year LOM

- Total net cash costs of US$742/oz (Years 1 to 5); and US$802/oz LOM

- Net All-In Sustaining Costs (“AISC”) of US$877/oz (Years 1 to 5), and AISC US$938/oz (LOM)

Notes

- Base case parameters assume a gold price of US$3,100/oz, silver price of US$35.50/oz, and an exchange rate (C$ to US$) of 0.74. All currencies are reported in U.S. dollars unless otherwise specified. NPV calculated as of the commencement of construction and excludes all pre-construction costs.

- US$4,200/oz Au case also based on US$51/oz Ag and FX of 0.71

- Initial capital costs, total cash costs and all-in sustaining costs are non-IFRS measures widely used in the mining industry as a benchmark for performance, but do not have standardized meanings under the Company's financial reporting framework. The methods used by the Company to calculate such measures may differ from methods used by other companies with similar descriptions. See “Non-IFRS Financial Measures” at the end of this news release for further details of these measures.

Mineral Resource Statement Inclusive of Mineral Reserves (effective September 30, 2025)

| Category | Quantity (Mt) |

Grade Au (g/t) |

Ag (g/t) |

Metal Au (Moz) |

Ag (Moz) |

| Open Pit | |||||

| Indicated | 191 | 0.78 | 4.6 | 4.8 | 28.0 |

| Inferred | 64 | 0.38 | 3.1 | 0.8 | 6.5 |

Notes

- Mineral resources are reported in relation to a conceptual pit shell. Mineral resources are not mineral reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate. All composites have been capped where appropriate.

- The MRE was completed under the supervision of Gilles Arseneau, P.Geo., from SRK who is a Qualified Person as defined under NI 43-101.

- Open pit mineral resources are reported at a cut-off grade (“COG”) of 0.20 g/t Au. COGs are based on a gold price of US$2,450/oz and a gold processing recovery of 87.2% and a silver price of US$27.50/oz and a silver processing recovery of 85.5%.

- Preliminary mining cost assumptions of C$2.60/tonne mined of waste, C$2.30/tonne mined of ore, and C$2.00/tonne mined of overburden, with an incremental mining cost of C$0.02/tonne/6m mined.

- Preliminary processing cost assumptions of C$14.50/tonne processed, general & administration assumption of C$0.90/tonne processed, stockpile cost assumption of C$0.75/tonne processed, and incremental ore mining cost of C$0.56/tonne processed. Overall pit shell slope angles ranged from 20 - 45°.

The Mineral Reserves for the Springpole Gold Project are based on the conversion of Indicated Mineral Resources within the current pit design. The Springpole Gold Project Mineral Reserves are shown below:

Springpole Proven and Probable Reserves

| Category | COG (g/t Au) |

Tonnes (Mt) |

Grade Au (g/t) |

Grade Ag (g/t) |

Contained Metal Au (Moz) |

Contained Metal Ag (Moz) |

| Proven | 0.27 | - | - | - | - | - |

| Probable | 0.27 | 102.0 | 0.94 | 4.9 | 3.1 | 16.1 |

| Total | 0.27 | 102.0 | 0.94 | 4.9 | 3.1 | 16.1 |

Notes

- This Mineral Reserve estimate is as of November 13, 2025 and is based on the new mineral resource estimate dated September 30, 2025.

- The Mineral Reserve estimation was completed under the supervision of Gordon Zurowski, P.Eng of AGP Mining Consultants Inc., who is a Qualified Person as defined under NI 43-101.

- Mineral Reserves are stated within the ultimate design pit based on:

- US$2,100/oz gold price and US$24/oz silver price.

- Pit Limit corresponds to a pit shell with a revenue factor of 0.60, corresponding to a US$1,260 /oz gold price and US$14.40/oz silver.

- A cut-off grade of 0.27 g/t Au for all pit phases.

- Preliminary mining cost assumptions of C$2.60/tonne mined of waste, C$2.30/tonne mined of ore, and C$2.00/tonne mined of overburden, with an incremental mining cost of C$0.02/tonne/6m mined.

- Preliminary processing cost assumptions of C$14.50/tonne processed, general & administration assumption of C$0.90/tonne processed, stockpile cost assumption of C$0.75/tonne processed, and incremental ore mining cost of C$0.56/tonne processed.

- Preliminary process recovery assumptions of 87.2% for gold and 85.5% for silver.

- An exchange rate of C$1.35 equal to US$1.00.

- The preliminary economic, cost and recovery assumptions used at the time of mine planning and reserve estimation may not necessarily conform to those stated in the economic model.

- Pit slope inter-ramp slope angle assumptions ranged from 22 - 54°.